Insights

A new era is dawning for nuclear power. Here’s how Small Modular Reactors and X-energy will lead the way.

10/16/2024

By Maritza Liaw

The U.S. is facing a looming energy shortage. Electricity demand is surging due to onshoring of manufacturing, the shift to electric vehicles and electrification, and an arms race in the AI and cloud computing sector. At the same time, baseload coal is being phased out. Renewables can fill some of that gap, but it’s increasingly clear that nuclear is back on the table as a serious option. And after 30 years, the U.S. is finally ready to build new nuclear power plants—and ready to build in a new way.

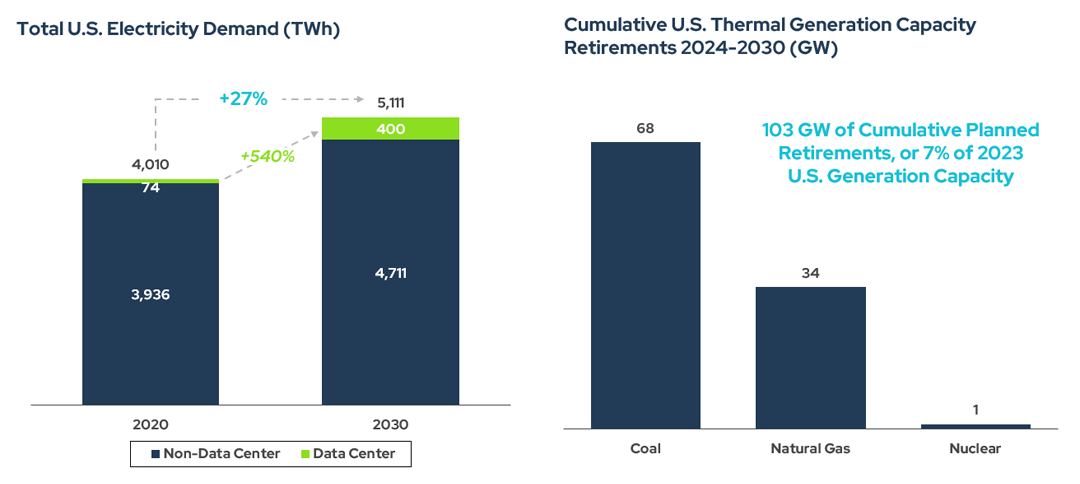

Today, major banks, nations, and big tech are embracing nuclear energy as key to a net-zero future. There is high demand for reliable, carbon-free baseload power. Nuclear is positioned to fill that gap. U.S. electricity demand is forecasted to grow 27% by 2030. At the same time, 103 GW of coal and natural gas baseload power plants will retire—a 7% decrease in current capacity.[i] While some countries have continued to build large reactors[ii] and the U.S. plans to restart two of its own decommissioned reactors,[iii] the monolithic designs of the past will not dominate new builds—Small Modular Reactors will.

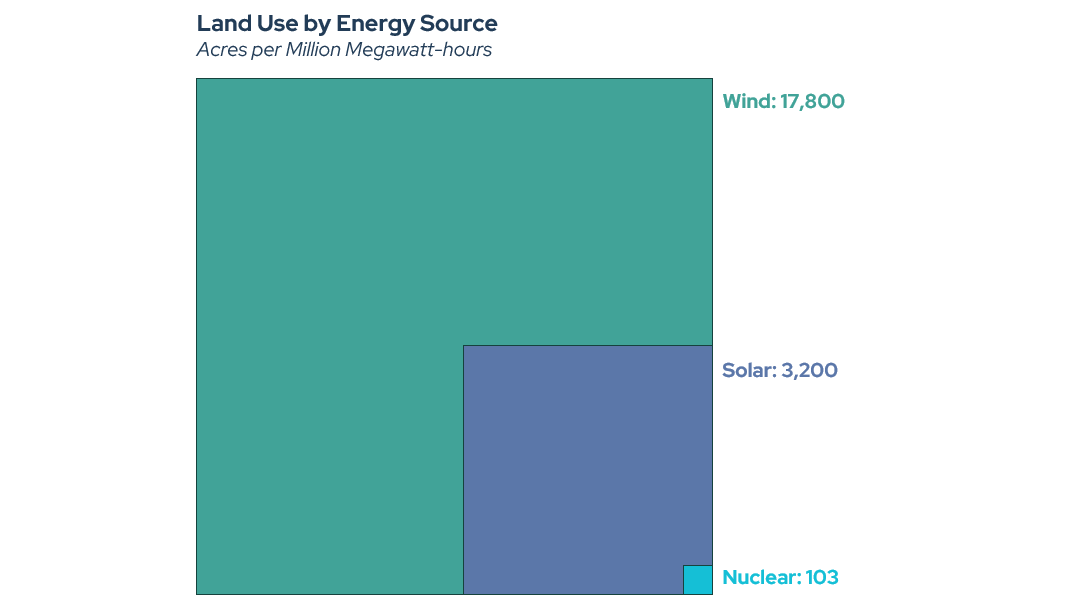

Nuclear offers the safest, lowest-carbon intensity, most land-use-efficient energy source on earth—with the highest availability and reliability. It’s a proven technology (50+ years in operation) with a long asset life (60 years). And unlike many other energy sources today, nuclear technology has strong, bipartisan support in the U.S. House and Senate.

1. Existing reactors have serious benefits—but are not the best option going forward. Why? The conventional nuclear power fleet represents ~20% of U.S. electricity supply and offers all the benefits above at costs on par with wind and solar, when operating licenses are extended to 60 and 80-years.[iv] But the U.S. has lost the ability to build conventional reactors on time and on budget.[v] The size, design, and outdated technology of large-scale nuclear plants make them more expensive and less repeatable, require too many specialty-trained craftspeople, and take too long to build.

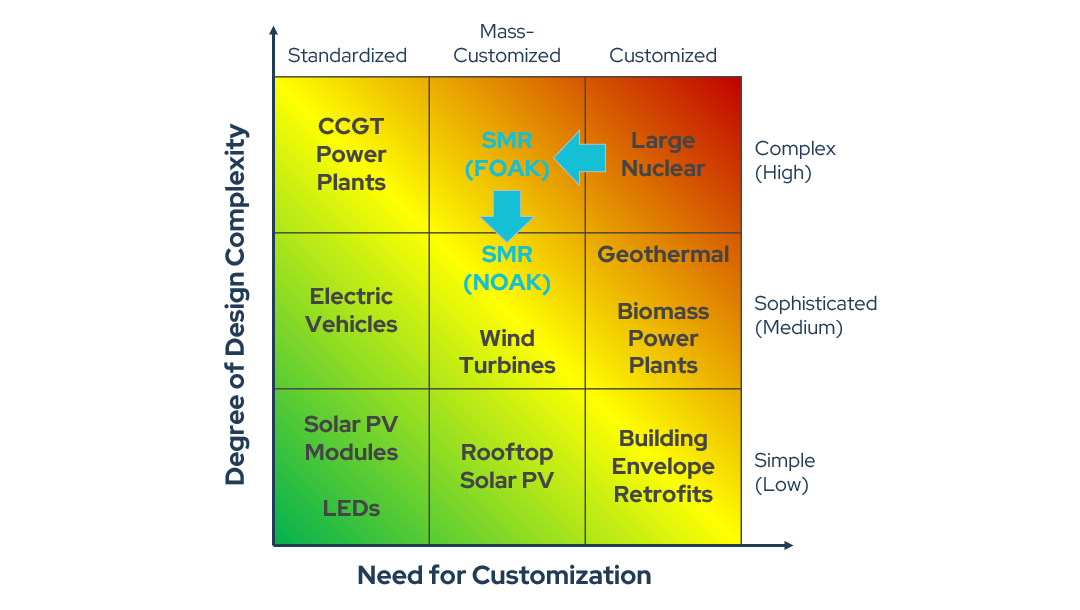

2. Enter Small Modular Reactors. “SMRs” transform nuclear power plants from complex, bespoke PROJECTS to simplified, repeatable PRODUCTS. This makes nuclear safer, more affordable, and more predictable to build and finance through standardized designs and construction methods.

Source: Adapted from Joule, “Accelerating Low-Carbon Innovation”

SMRs exceed safety standards and can reduce the cost of new nuclear construction by more than 60%.[vi] SMRs can do this by getting to “nth-of-a-kind” cost savings faster than conventional reactors due to standardized designs, smaller and cheaper units of repetition, and commercial order books for 10+ units at a time.

We believe “Gen IV” SMR designs are specifically advantaged. How? Water-based SMRs (“Gen III+”) are similar to the Vogtle design but smaller in scale. The Gas, Molten Salt, and Liquid Metal-cooled reactors (“Gen IV”) operate under lower pressures and even higher safety margins. They require fewer expensive safety systems to achieve the same or better safety standards.

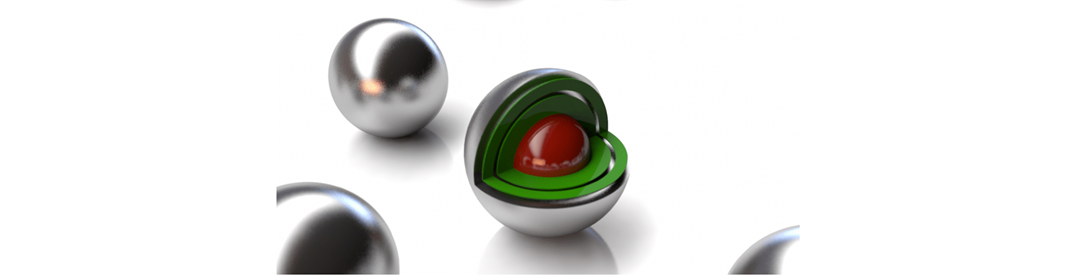

- Most of these reactors use TRISO fuel, which the DOE has declared “the most robust nuclear fuel on earth.”[vii] TRISO is fissile uranium wrapped in 3 layers of protective carbon and ceramic. Radioactivity is trapped inside; heat can escape. The heat is used to create steam, turn a turbine, and generate electricity. TRISO particles “cannot melt in a commercial high-temperature reactor and can withstand extreme temperatures that are well beyond the threshold of current nuclear fuels.”[viii]

- Because the poppy seed-sized TRISO fuel particles act as their own containment vessels, they largely eliminate the need for expensive steel and concrete structures that conventional reactors require, which dramatically reduces construction costs.

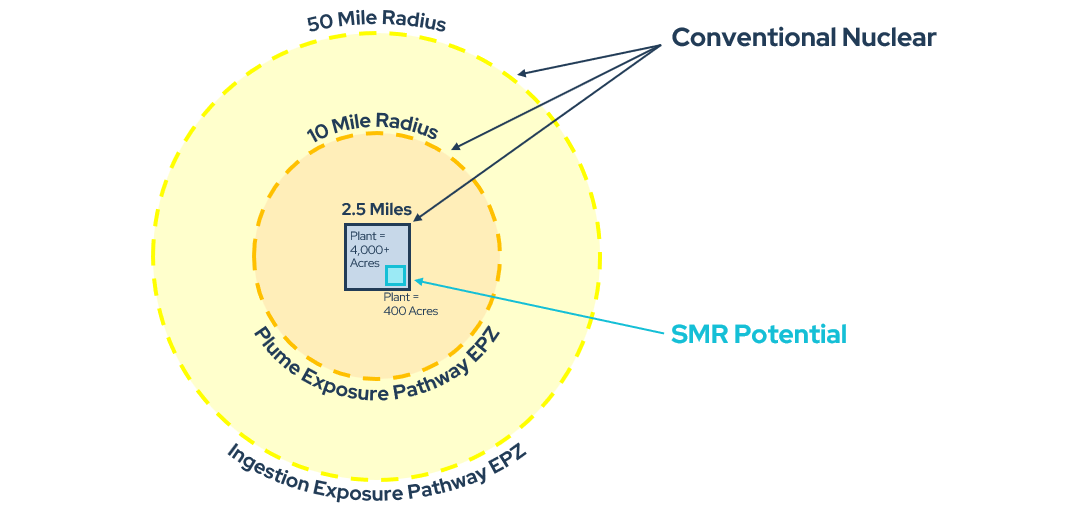

- Furthermore, smarter containment means Gen IV Emergency Planning Zones (EPZ) may be 90+% smaller than traditional reactors. That efficiency drives faster development, permitting, licensing, and construction for the entire project.[ix]

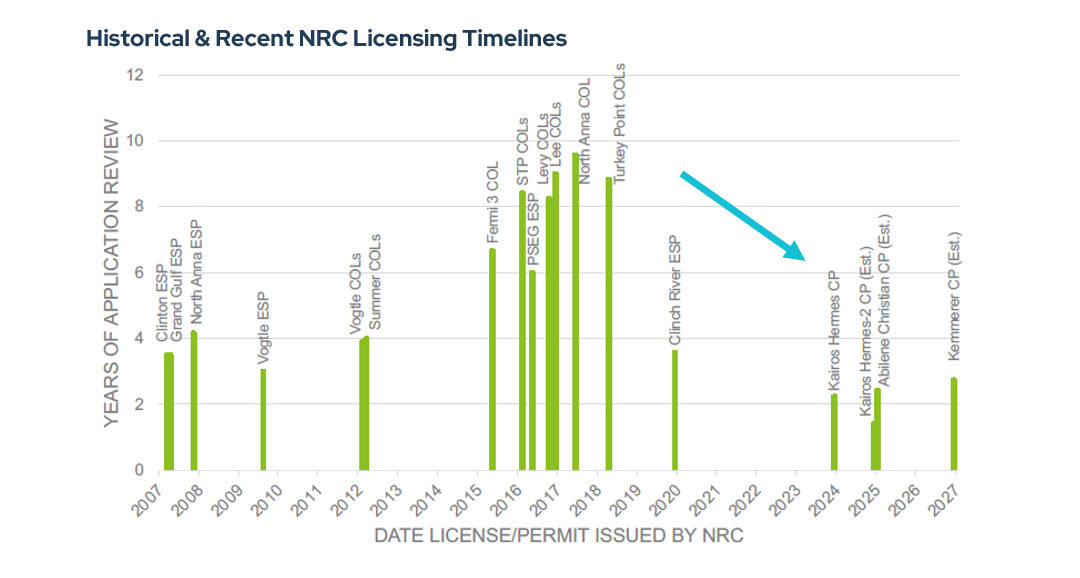

3. Many investors have been more interested in fusion than in fission. They have been willing to take technical risk (“will it work”), but not regulatory risk (“will it be permitted”). Nuclear fission is proven technology. It generates carbon-free electricity today. While nuclear fission is far more regulated than fusion, the Nuclear Regulatory Commission (NRC) is more efficient than people think.

Yes, NuScale spent about $500 million and Westinghouse spent an estimated $1 billion to obtain NRC licenses for their designs. And project application reviews stretched to 8–10 years this century.

But the 2024 ADVANCE Act has formalized a shift in the NRC mission to include commercial goals. In addition to its already-robust safety mandate, the NRC is directed to engage more efficiently with stakeholders, technology innovators, and project developers. There is already proof: the NRC approved a construction permit for Kairos Hermes in 2 years, accepted a construction permit application for TerraPower’s Natrium reactor, and set a timetable for 27 months.[x]

4. The Gen IV reactor technology market will coalesce around 2–3 technologies. Beyond reactor and fuel design, repeated deployments—learning by doing—will speed a few companies up the learning curve and down the cost curve.[xi]

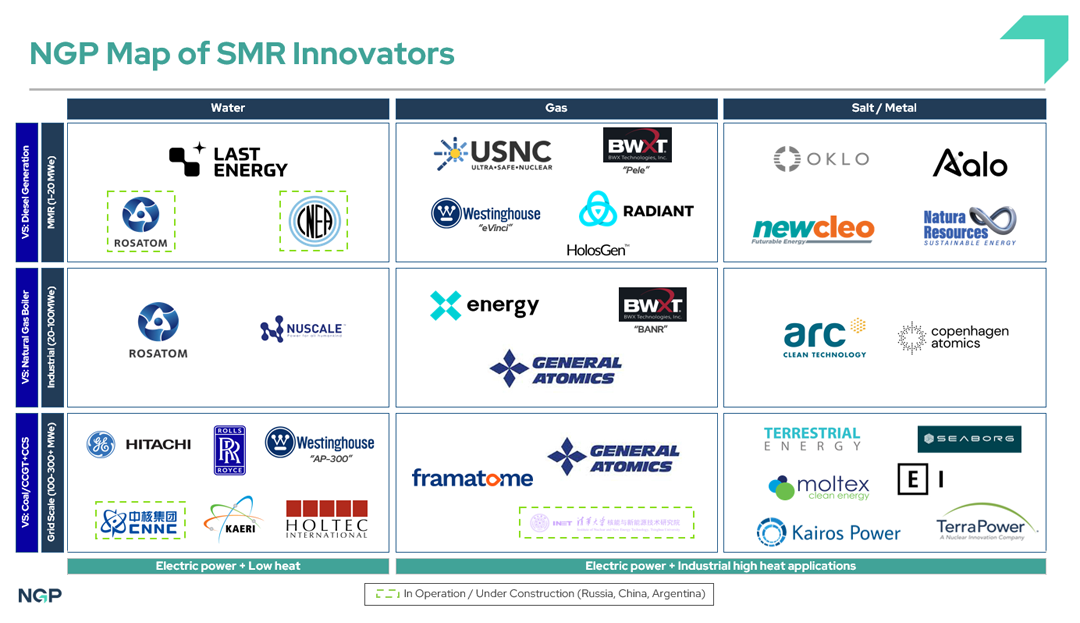

The field of SMRs is crowded today. SMRs come in a variety of designs that can be categorized by size and coolant type. There are over 50 innovators worldwide:

The SMR field will narrow to a small group that will deploy projects in the next decade. They will be distinguished by strength and depth of team, their designs’ technical merit and operating history, strong commercial partnerships, and capital.

NGP has recently invested in X-energy.

- Nuclear energy requires a broad skill set and the X-energy team has depth of experience across engineering, licensing, public engagement, procurement, construction, and financing.

- X-energy employs a High-Temperature Gas Reactor (“HTGR”) design, the basis of which has been proven over the course of 50 years of testing and operations.[xii] Due to higher output temperatures, HTGRs are useful for both industrial heat and grid electricity applications.

- X-energy’s reactor size of 80MWe, and plant size of 320MWe is well-suited to reliability standards of industrial customers and data centers, including potential behind the meter applications.

- Today, X-energy announced 5GW of projects in a commercial framework with Amazon, in addition to its Seadrift, TX project underway with Dow.

- Today, X-energy also announced approximately $500 million of new equity funding to advance licensing and project development.

The future for new nuclear energy is bright. You can find more information about the announcements here.

[i] EIA “Short Term Energy Outlook” (January 2024). Goldman Sachs “Generational Growth, AI, data centers and the coming US power demand surge” (April 28, 2024). Thunder Said Energy “US CO2 Emissions and Decarbonization Model” (April 2024).

[ii] Including China, India, South Korea, and France (World Nuclear Association)

[iii] Three Mile Island Unit 1 and Palisades in Michigan

[iv] Lazard, LCOE v 17 (2024). Turkey Point Nuclear Power Plant, Units 3 and 4 are examples of license renewals to 80-years of total projected operation.

[v] The recent reactors built at the Vogtle plant in Georgia are estimated to cost more than $165/MWh (DOE) on a levelized cost of energy (“LCOE”) basis and bankrupted Westinghouse in the process.

[vi] Source: DOE

[vii] Source: DOE

[viii] Source : Office of Nuclear Energy

[ix] Source: NGP analysis. Diagram is illustrative and plant scales have been generalized. Discussion of EPZ at NRC and energy.virginia.gov. Many SMRs propose to use plant boundary (or similar scale) as EPZ.

[x] Source: NRC

[xi] “A committed orderbook of 5–10 deployments of a single reactor design is the first essential step for catalyzing commercial liftoff in the US.” (DOE)

[xii] NEA, High-temperature Gas-cooled Reactors and Industrial Applications (2022)

The content is being provided for informational and discussion purposes only. This content does not constitute an offer to sell or a solicitation of an offer to purchase an interest in any NGP fund. Any such offer or solicitation, if any, would be made only pursuant to the definitive confidential private placement memorandum, limited partnership agreement and subscription documents and other similar disclosure documents for the relevant NGP fund, which describe certain risk factors, tax information and potential conflicts of interest.

Furthermore, this content does not purport to be all-inclusive, cover all relevant information about the topics and industries discussed or contain all of the information that may be needed or desired to evaluate a potential investment and is not intended to be relied upon as the basis for an investment decision. This content should not be construed as legal, business, tax, investment, accounting or other advice. Investing involves a high degree of risk and no assurance can be given that investment objectives will be achieved or that investors will receive a return on their capital. You should carefully consider, and conduct an independent analysis of, the data, analysis and views presented herein.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “anticipate”, “forecast”, “estimate”, “intend”, “continue”, “target” or “believe” (or the negatives thereof) or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or actual outcomes may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions. No representation or warranty is made as to outcomes such forward-looking statements.

References to portfolio companies should not be construed as a recommendation for any particular company or security. Any investments or portfolio companies identified herein are not representative of all investments made by NGP and there can be no assurance that such investments will be profitable or have similar characteristics to those described herein. The inclusion of any third-party firm and/or company names, brands and/or logos does not imply any affiliation with these firms or companies. None of these firms or companies have endorsed NGP or any other fund managed by NGP or any associated entities or personnel.